The landscape of college admissions and financing continues to shift in ways that demand careful attention from students and families preparing for 2026. Georgetown University's Center on Education and the Workforce projects that 72 percent of jobs will require postsecondary education by 2031, raising the stakes for getting this process right. Yet the path forward remains navigable for those who understand both the competitive realities of admissions and the strategic opportunities for funding an education.

Family concerns remain consistent year after year: cost, access to scholarships, and the specter of debt. The annual Sallie Mae "How America Pays for College" survey ranks these as parents' top three worries when it comes to sending a child to college. The good news is that $190.1 billion was awarded to undergraduates in 2024, and approximately 76 percent of students received some form of financial aid. The families who secure the most support are not always those with the greatest need. They are the families who best understand how the system works.

The 2026 Admissions Landscape

Students applying to college in 2026 should not expect an easier path than their predecessors faced. The trend of increasing selectivity shows no signs of reversing, and several factors continue to drive acceptance rates downward at schools across the selectivity spectrum.

The Common Application reported a 21.3 percent surge in overall submissions in recent admissions cycles, and students are now applying to an average of six to ten schools compared to four to six just a decade ago. This flood of applications has transformed the admissions calculus at institutions that were once considered reliable options. Auburn University provides a striking example: its acceptance rate stood at 85 percent in 2020 but dropped to 39 percent by 2024. Southern and flagship public universities are experiencing unprecedented demand, turning former "likely" schools into genuine reaches for many applicants.

The return of standardized testing requirements at elite institutions adds another layer of complexity. MIT, CalTech, all Ivy League schools, Purdue University, and the University of Texas at Austin have reinstated test requirements, with Cornell and Stanford following suit for upcoming cycles. Even at schools maintaining test-optional policies, data consistently shows that students who submit strong scores have measurable advantages in the admissions process. The practical advice here is straightforward: if your scores fall within or above the middle 50 percent range for a school's admitted students, submit them.

Strategic positioning matters more than ever. Certain majors, including business, engineering, computer science, and nursing, face significantly tougher competition than others. Male applicants currently hold a slight advantage in liberal arts programs, where female students comprise the majority of applicant pools. Students willing to consider alternate start dates, satellite campuses, or less conventional majors may find doors opening that would otherwise remain closed.

Understanding College Costs

Before developing a payment strategy, families need a clear picture of what college actually costs in 2026. The College Board's Trends in College Pricing 2025 report provides the most authoritative data on published tuition rates for the current academic year.

For 2025-2026, average published tuition and fees stand at $45,000 at private nonprofit four-year colleges. Public four-year institutions charge an average of $11,950 for in-state students and $31,880 for those coming from out of state. Community colleges remain the most affordable option, with public two-year in-district tuition and fees averaging $4,150.

These figures represent only a portion of the total expense. The Education Data Initiative calculates that when housing, food, books, and transportation are included, the average in-state student at a public university faces total costs of approximately $27,146 annually. Students at private nonprofit institutions can expect total costs approaching $58,628 per year. U.S. News data shows that at the highest end, schools like the University of Southern California and Brown University now publish tuition and fees exceeding $74,000.

The distinction between sticker price and net price is critical for families to understand. The National Association of College and University Business Officers reported that private colleges are now discounting tuition by an average of 56.3 percent for first-time, full-time students, the highest discount rate on record. Harvard University illustrates this gap: while its published tuition and fees reach $64,796, the average cost to students after need-based grants drops to approximately $15,126. A growing number of institutions, including Princeton and Notre Dame, commit to meeting 100 percent of every admitted student's demonstrated financial need without loans.

Every college is required to provide a Net Price Calculator on its financial aid website. Using these tools before finalizing a college list can prevent costly surprises and reveal that some higher-priced schools may ultimately cost less than their supposedly affordable counterparts.

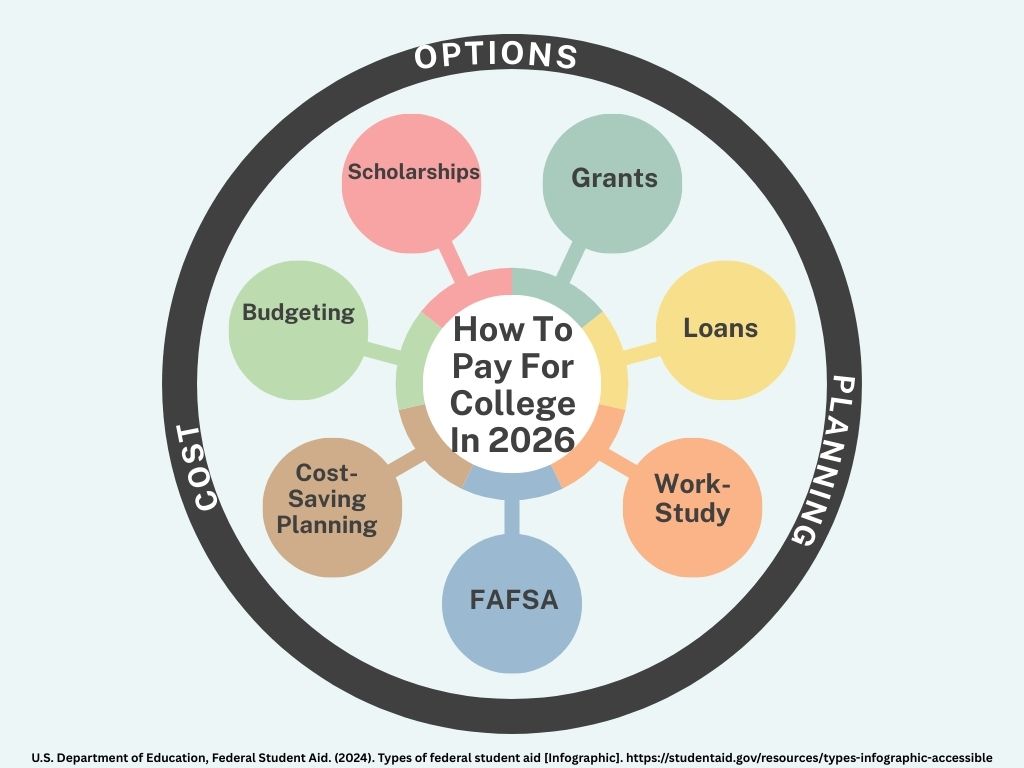

The Best Strategies for Paying for College

The foundation of any college financing plan is the Free Application for Federal Student Aid. The U.S. Department of Education announced that the 2026-2027 FAFSA opened on September 24, 2025, marking the earliest launch in the program's history. After years of delays and technical difficulties, families can now begin the process on schedule.

The federal deadline for the 2026-2027 FAFSA is June 30, 2027, but this date is misleading. State and institutional deadlines arrive much earlier. Federal Student Aid lists March 2, 2026 as the priority deadline for most colleges. Financial aid is frequently distributed on a first-come, first-served basis, meaning delayed applications may result in reduced awards or no aid at all. Students should aim to submit their FAFSA as close to October 1 as possible.

The 2026-2027 application includes several improvements worth noting. The form has been simplified to 36 questions, instant identity verification is now available for users with Social Security numbers, and the Student Aid Index has replaced the older Expected Family Contribution metric. Students will also learn their Pell Grant eligibility earlier in the process than in previous years.

The most effective payment strategies layer multiple funding sources in a specific order of preference. Grants and scholarships should form the foundation of any financial aid package because they require no repayment. Federal Student Aid sets the maximum Pell Grant at $7,395 for 2025-2026 for eligible students. State grant programs, such as California's Cal Grant, add another layer of support. Institutional grants and scholarships from the colleges themselves often represent the largest source of aid, particularly at private institutions with significant endowments. External scholarships from private organizations round out this category.

Work-study programs offer the next tier of support, providing part-time employment that helps students cover expenses while gaining professional experience. Federal work-study positions are available both on and off campus and are designed to accommodate academic schedules.

Federal student loans should be considered only after grant aid and work-study have been maximized. Subsidized loans, available to students with demonstrated need, carry a significant advantage: the government pays the interest while the student remains enrolled. Unsubsidized loans are available regardless of need but begin accruing interest immediately. Federal Student Aid caps borrowing for dependent undergraduates at $31,000 over the course of their education.

Parent PLUS loans and private loans should be approached with caution and used only when other options have been exhausted. These carry higher interest rates and fewer protections than federal student loans.

The scholarship search process rewards those who think locally. Civic organizations, community foundations, and places of worship frequently offer awards with far fewer applicants than national competitions. Many students overlook these opportunities, assuming smaller awards are not worth pursuing, but the reduced competition significantly increases the odds of winning. Before accepting any outside scholarship, contact the financial aid office at your intended school to understand how external awards affect your institutional aid package. Some schools reduce their own grants dollar for dollar when outside scholarships arrive.

Families who receive financial aid offers that fall short of their needs can and should appeal. A professional judgment review allows financial aid officers to adjust awards based on documented changes in circumstances, such as job loss, medical expenses, divorce, or other hardships. Presenting competing offers from peer institutions, done respectfully, can also prompt schools to reconsider their packages.

The Application Timeline

For students planning to enter college in fall 2026, the application process is already underway. Most applications, including the Common Application, opened in August 2025. Understanding the different deadline categories and their strategic implications is essential for maximizing admission chances.

Early Decision and Early Action deadlines typically fall between November 1 and November 15, 2025. Early Decision is a binding commitment: students accepted through ED must enroll and withdraw all other applications. This option makes sense only for students who have identified a clear first-choice school and whose families are confident they can manage whatever financial aid package arrives. The tradeoff is real. ED applicants often see higher acceptance rates, with some schools admitting more than a quarter of their incoming class through this pathway.

Early Action offers many of the same timing benefits without the binding commitment. Students receive decisions earlier, often by mid-December, but retain the freedom to compare offers from multiple schools until the May 1 National College Decision Day. Some institutions offer Restrictive Early Action, which limits the number of early applications a student can submit, so reviewing each school's specific policies is important.

Regular Decision deadlines cluster between January 1 and January 15, 2026, though some schools extend into early February. The College Board notes that the University of California system maintains a fixed November 30 deadline with no early application options. Rolling admissions programs accept applications throughout the spring until available spots are filled, though financial aid often runs thin for late applicants.

The optimal months for submitting applications depend on your strategy. October and early November represent the prime window for early applications, coinciding with the opening of both the FAFSA and CSS Profile. Students applying Regular Decision should aim to finalize their materials before winter break, leaving January for final reviews rather than frantic writing. The Common Application platform tends to slow down as major deadlines approach, making last-minute submissions risky.

A practical timeline for the senior year begins in the fall with FAFSA and CSS Profile submission in October, followed by early application deadlines in November. Regular Decision applications should be substantially complete by late December, with final submissions in the first two weeks of January. Students who wait until the night before a deadline to hit submit are gambling with technical failures that could cost them their spot.

Building a Strategic College List

The shifting admissions landscape demands a recalibrated approach to building a college list. Schools that served as reliable safety options a few years ago may no longer fulfill that role. A balanced list should include institutions across the selectivity spectrum, with genuine safety schools where acceptance odds exceed 50 percent.

Looking beyond brand-name institutions often reveals excellent educational opportunities at lower cost and with higher admission probability. Regional universities and liberal arts colleges frequently offer strong academics, generous merit aid, and close faculty relationships that flagship institutions cannot match. Honors colleges within public universities provide a selective, small-college experience at public school prices.

The growing backlash against elite institutions' exclusivity has prompted more families to question whether the premium for a prestigious name delivers commensurate value. For many students, the answer is no, particularly when accounting for the debt required to finance that prestige.

Evaluating true affordability requires running Net Price Calculators at every school under consideration before applications go out. A private college with a high sticker price but generous institutional aid may ultimately cost less than a public university offering limited support. Four-year graduation rates matter here as well. An institution where students commonly take five or six years to finish adds tens of thousands of dollars to the true cost of a degree.

Taking Control of the Process

The 2026 college landscape presents genuine challenges, but it rewards families who approach the process strategically. Filing the FAFSA immediately when it opens, applying early when circumstances warrant, building a diverse funding portfolio that prioritizes grants over loans, and constructing a balanced college list are the concrete steps that separate successful outcomes from disappointing ones.

The uncertainty that pervades college admissions today is real, but preparedness remains the antidote. Students with perfect credentials face rejection from schools their predecessors entered with ease, while others with less traditional profiles find acceptance at institutions that seem improbable. What distinguishes successful applicants is not luck but rather a clear-eyed understanding of the process and a willingness to execute the steps that maximize their chances.

The resources exist for those who know how to access them. Nearly $200 billion flows to undergraduate students annually through various aid channels. The families who capture the largest share of that support are those who file early, apply broadly, and approach the financial aid process with the same strategic attention they bring to the applications themselves.

From Access to Completion: How Institutions Raise First-Generation Graduation Rates

From Access to Completion: How Institutions Raise First-Generation Graduation Rates

College Survival Guide: What to Do Before You Arrive and Every Year After

College Survival Guide: What to Do Before You Arrive and Every Year After

How to Use Your Cultural Identity to Stand Out in Business Careers

How to Use Your Cultural Identity to Stand Out in Business Careers

AI for Job Seekers: Safe, Smart Tools That Help You Stand Out to Employers

AI for Job Seekers: Safe, Smart Tools That Help You Stand Out to Employers

What Employers and Admissions Officers Look for in International Candidates

What Employers and Admissions Officers Look for in International Candidates